Solana (SOL) peaked in users on March 17 and has been declining since then. Despite this, the SOL price remains in the spotlight as trading activity remains high, indicating continued interest. This suggests that while user numbers have declined, engagement remains high.

Technical indicators such as the Relative Strength Index (RSI) show good condition, but caution should be exercised as the EMA lines indicate a possible downtrend. This combination of heavy trading activity and uncertain technical signals raises the question of whether SOL is preparing to consolidate before reaching new highs.

The SOL RSI indicator remains healthy

The Relative Strength Index (RSI) for Solana is currently at 48. This reflects a restrained selling atmosphere, not enough to classify the asset as undervalued or give it overbought status. This balance indicates that Solana may enter a consolidation phase due to its price.

The RSI indicator measures the speed and change of price movements on a scale of zero to 100. Typically, a value above 70 indicates a potentially overbought condition, while a value below 30 suggests that the asset may be oversold.

This balance of RSI levels represents possible outcomes for Solana. One scenario could be a market stabilization where the price remains stable, indicating that the market is in a wait-and-see mode. Traders and traders alike can look for clear indicators of where the SOL price will go next.

Read more: Solana (SOL) Price Forecast for 2024/2025/2030

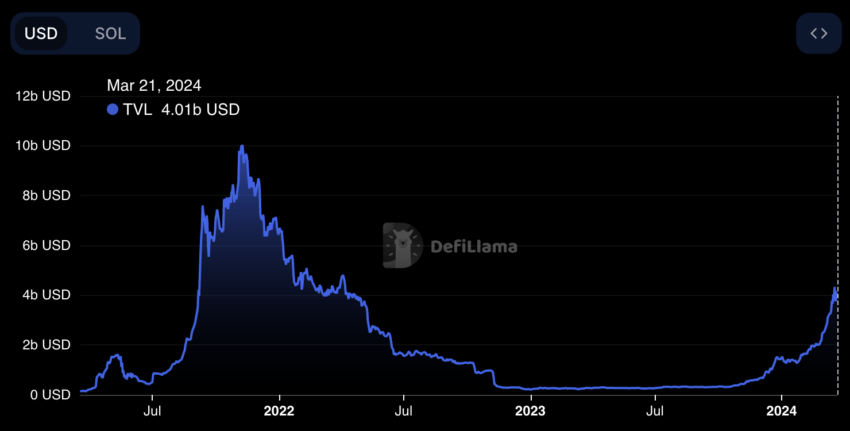

Solana Total Value Locked exceeds $4 billion – for the first time in 2 years

Total Value Locked (TVL) in the Solana ecosystem recently reached a significant milestone, surpassing $4 billion for the first time since April 2022.

This metric, which represents the cumulative value of assets held on decentralized finance (DeFi) platforms in Solana, is essential to assess the overall viability of the ecosystem, the usability of its applications and the level of active user participation. TVL's growth is a strong indicator of renewed investor confidence and growing interest in Solana DeFi offerings.

In 2021, Solana's TVL saw an impressive peak of over $10 billion. However, after a period of rapid growth, there was a significant decline, causing TVL to regress significantly. In the period from November 2022 to November 2023, TVL data fluctuated between USD 250 and USD 350 million, suggesting a phase of stabilization and consolidation in the ecosystem. This period of relative stability laid the groundwork for the recent rally, marking a promising surge in Solana's DeFi activity.

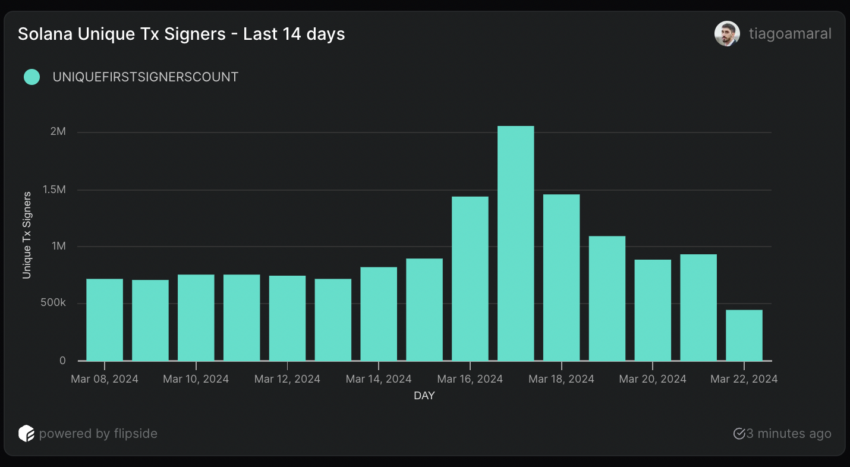

Solana recently reached 2 million users

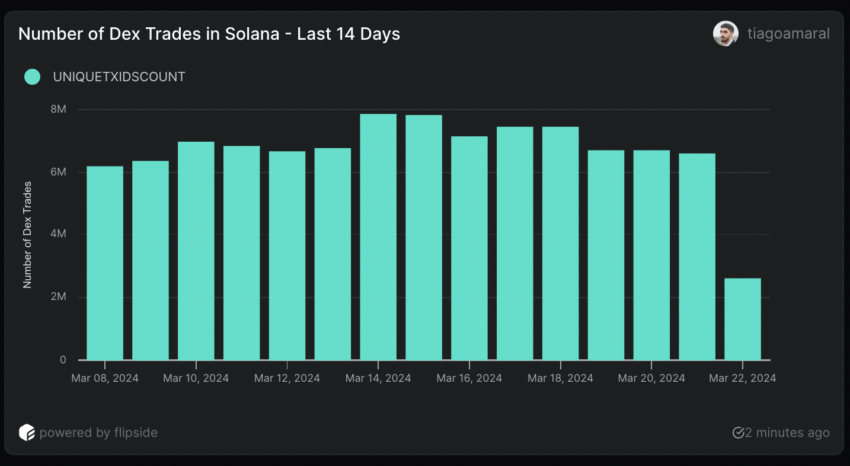

Analysis of Solana's two on-chain metrics reveals some interesting scenarios. DEX's record daily trading volume, which reached 7.86 million on March 14, is the highest ever. Since March 8, the trading volume on Solana DEX has consistently exceeded 6 million transactions per day. This represents a significant increase compared to the period prior to December 2023, when peak daily trading volume on Solana DEX instruments reached the cap of 2.2 million.

While the number of DEX transactions is well above the historical average, the rate of growth is slowing and the number of daily DEX transactions has been declining since March 15. Between that day and March 18, the price of SOL rose from $176 to $208 and then entered a correction.

Another notable metric from Solana's on-chain data is the daily unique transaction signature count, which essentially tracks the daily number of different users executing transactions on the network.

Since January 2024, this number has shown a steady increase. By March 8, this number had reached 717,000 users, and by March 17 it had increased to over 2,000,000, an increase of 178.94% in less than ten days. However, after Solana gained over 2,000,000 unique users in a single day, the number of daily signers began to decline, reaching 936,000 on March 21.

While this number still far exceeds the number of daily users Solana was recording just a few weeks ago; this decline may indicate consolidation before the network begins to expand again.

SOL Price Forecast: EMA Airlines may soon enter a consolidation phase

Analyzing the 4-hour SOL price chart, we can clearly see that the 20 EMA line is almost crossing below the 50 EMA line. Exponential moving averages (EMAs) are technical indicators used in financial markets to smooth out price data over a specific period, giving more weight to the most recent prices so they respond better to new information.

Unlike simple moving averages (SMAs), EMAs respond more quickly to price changes, which makes them valuable for identifying trend directions and potential reversals.

When a short-term EMA such as the 20 EMA crosses below a longer-term EMA such as the 50 EMA, it can signal a change in dynamics towards a bearish outlook, suggesting that short-term prices are declining compared to the longer term. This scenario is often interpreted as consolidation, indicating a period in which prices stabilize after a move as buyers and sellers reach equilibrium.

Read more: 6 Best Platforms to Buy Solana (SOL) in 2024

As you can see from the SOL price chart, the short-term EMAs are well above the longer-term EMAs such as 100 and 200, but correspond to the current price level. In this case, this suggests consolidation of the SOL price in the short term.

If Solana enters a correction phase, the price could test the support at $161. If that's not enough, the next target could be $137. This would mean a correction of 21%. However, if the SOL price rally continues, it could return to a consolidation phase and soon return to the $210 level, which would represent a 20% increase from the current price.

Reservation

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our Terms, Privacy Policy and Disclaimers have been updated.